owner's draw vs salary uk

Single-member LLC owners are also considered sole proprietors for tax purposes so they would take a draw. When you pay yourself a salary you decide on a set wage for yourself and pay yourself a fixed amount every time you run payroll.

Salary Or Draw How To Pay Yourself As A Business Owner Or Llc Quickbooks

Heres a high-level look at the difference between a salary and an owners draw or simply a draw.

. If you draw 30000 then your owners equity goes down to 45000. Owners draws are usually taken from your owners equity. As we outline some of the details below.

All wages need to be calculated and recorded through PAYE. Before you make the owners draw vs. You pay yourself a regular salary just as you would an employee of the company.

First lets take a look at the difference between a salary and an owners draw. As long as you keep your personal and business expenses separate ideally using separate bank accounts youre good. Heres a high-level look at the difference between a salary and an owners draw or simply a draw.

A salary is a set amount that is paid to an employee or business owner on a regular basis with a paycheck that includes payroll tax withholdings. An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company LLC or S corporation by the owner for their personal use. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary.

An owners draw also known as a draw is when the business owner takes money out of the business for personal use. 70000 contributions 30000 share of profits 15000 owners draw 85000 partner equity balance. Updated on July 30 2020.

An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company LLC or S corporation by the owner for their personal use. Wages are seen as an allowable business expense and are tax-deductible. Draws can happen at regular.

Patty could withdraw profits generated by her business or take out funds that she previously contributed to her company. Clients and customers pay you you pay taxes done and done. An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company.

When you do business in your own name as a sole proprietorship there isnt really such a thing as a salary or a distribution. In contrast the draw method allows you to withdraw from your owners equity account as your profits increase. Owners can withdraw money from the business at any time.

If you dont actively work for the company you can receive dividends which is different from an owners drawa dividend is non-taxable. Owners drawing owners draw or simply draw is a method of taking out money from a business by its owners. Keep in mind that a partner cant be paid a salary but a partner may be paid a guaranteed payment for services rendered to the partnership.

Its a way for them to pay themselves instead of taking a salary. Owners equity refers to your share of your business assets like your initial investment and any profits your business has made. On the other hand owners of corporations or S-corporations generally cant take a draw and would.

Before you can decide which method is best for you you need to understand the basics. Through the salary method youll receive a fixed amount of money regularly as an employee. On the other hand a payroll salary offers more stability and less planning at the expense of less flexibility.

Owners draws can be scheduled at regular. If you own a company of your own you can register as an employer and pay yourself a wage. Business owners still have to pay themselves but how.

For certain business structures there is no restriction on owners to withdraw money from the business as and when needed. If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses. As a business owner you can receive compensation for your work in your company through an owners draw or a salary.

Owners draws can give s corps and c corps extra tax savings. Owners draw is a method of paying yourself as an. Drawings are made by sole traders from their business accounts.

Understand the difference between salary vs. Here is her partner equity balance after these transactions. An owners draw is not taxable on the businesss income.

If you actively work for a C corp even if youre the majority owner your only option for payment is taking a salary as a W-2 employee. Taking Money Out of an S-Corp. Thus technically the owners draw is not a salary.

For example if you invested 50000 into your business entity and your share of the profit is 25000 then your owners equity is at 75000. She may also take out a combination of profits. Learn more about the pros and cons of owners draw versus salary and find out which one is best for you.

These amounts are commonly referred to as an owners draw. Many small business owners compensate themselves using a draw rather than paying themselves a salary. Wages can only be paid by registered companies and employers.

Owners equity is made up of any funds that have been invested in the business the individuals share of any profit as well as any deductions that have been made out of the account. The business owner takes funds out of the business for personal use. Understand the difference between salary vs.

An owners draw refers to an owner taking funds out of the business for personal use. That means that an owner can take a draw from the business up to the amount of the owners investment in the business. Owners draw in a C corp.

Likewise if youre an owner of a sole proprietorship youre considered self-employed so you wouldnt be paid a salary but instead take an owners draw.

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business In Canada Youtube

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1187401773-acd76b74dd7e4628bec5e56589b82141.jpg)

How To Pay Yourself As A Business Owner

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business In Canada Youtube

How To Pay Yourself As A Business Owner Xero Sg

How To Pay Yourself As A Business Owner In The Uk Freshbooks Blog

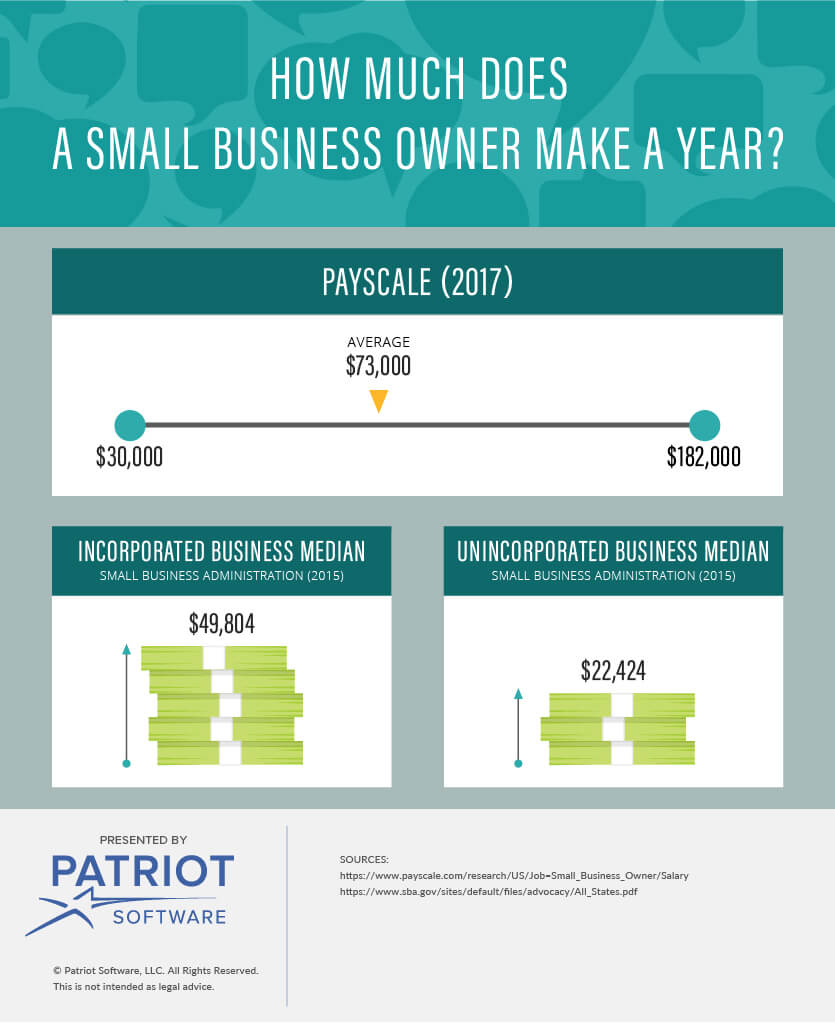

How Much Do Small Business Owners Make Surprising Averages

Salary Or Draw How To Pay Yourself As A Business Owner Or Llc Quickbooks

Costum Internship Email Template Doc Sample Email Templates Advertising Strategies Email Marketing Strategy

Zinger Model David Zinger Employee Engagement Speaker Employee Engagement Employee Engagement Model Engagement Quotes

Privacy Policy For Influencers Bloggers And Online Business Owners In 2020 Online Business Business Owner Privacy Policy

Owner S Salary Small Business Uk

How To Pay Yourself As A Small Business Owner Gusto

Truck Repair Manual Isuzu 4hk 1 And 6hk 1 Engine Sensor Locations Erwin Salarda Truck Repair Repair Manuals Crankshaft Position Sensor

How To Pay Yourself As A Small Business Owner Sage Advice United Kingdom

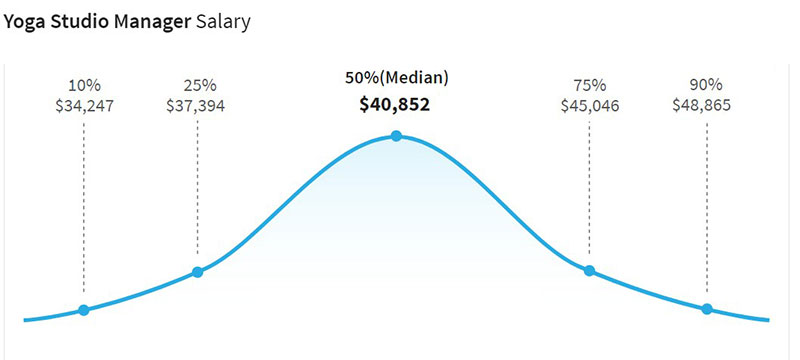

Yoga Studio Owner Salary How Much Can You Make

/GettyImages-1187401773-acd76b74dd7e4628bec5e56589b82141.jpg)

How To Pay Yourself As A Business Owner

How To Pay Yourself From Your Small Business Legalzoom Com

Gender Differences In Finances Men Vs Women Man Vs Women Money